Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 percent to address rapid inflation but may consider lowering them as price increases subside. However, the timing of rate cuts remains uncertain, with officials awaiting further evidence of sustained inflation moderation, likely delaying any action until June or July. Despite criticism, Powell reaffirmed the Fed's commitment to basing decisions on economic factors rather than political considerations.

AUDUSD - H4 Timeframe

After the initial break of structure on the 4-hour timeframe of AUDUSD, we’ve seen price make a run for the previous area of supply. This region is crucial because it is a supply zone that is being tested right after a sweep of liquidity. Also, we see the bearish array of the moving averages, as well as the equal lows down below, which could serve as a good level for another run on liquidity. All in all, my sentiment here is bearish.

Analyst’s Expectations:

Direction: Bearish

Target: 0.65210

Invalidation: 0.65781

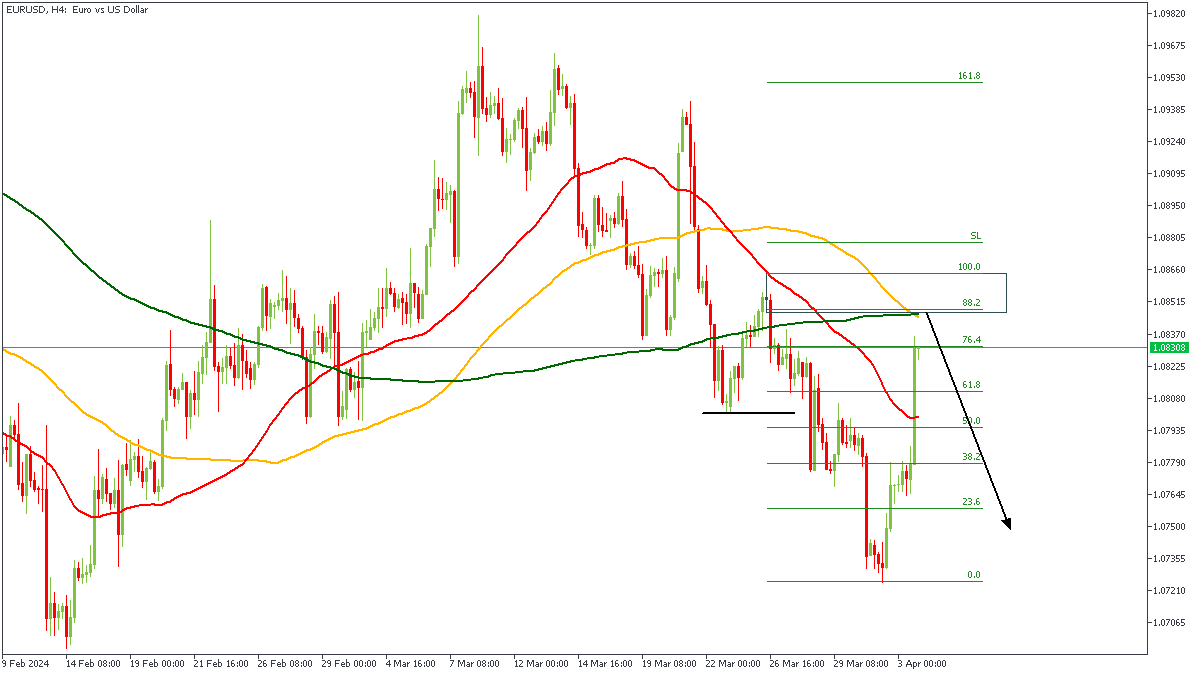

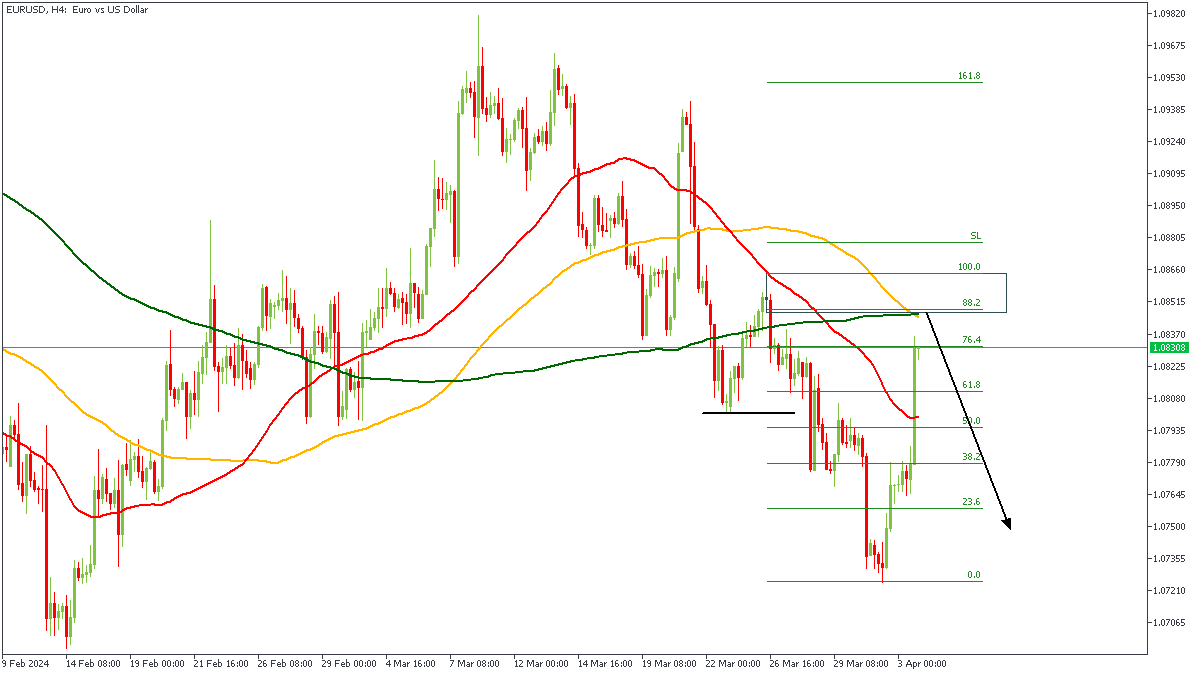

EURUSD - H4 Timeframe

EURUSD recently broke below the previous low, hence, I expect price to make a return to the supply zone that engineered the break of structure. Also, the confluence of the 100 and 200 period moving averages may be considered a viable area of resistance, especially since the moving averages are in a descending order. Finally, the 88% of the Fibonacci retracement, and the rally-base-drop supply zone are the final pieces of the puzzle towards my bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 1.07797

Invalidation: 1.08657

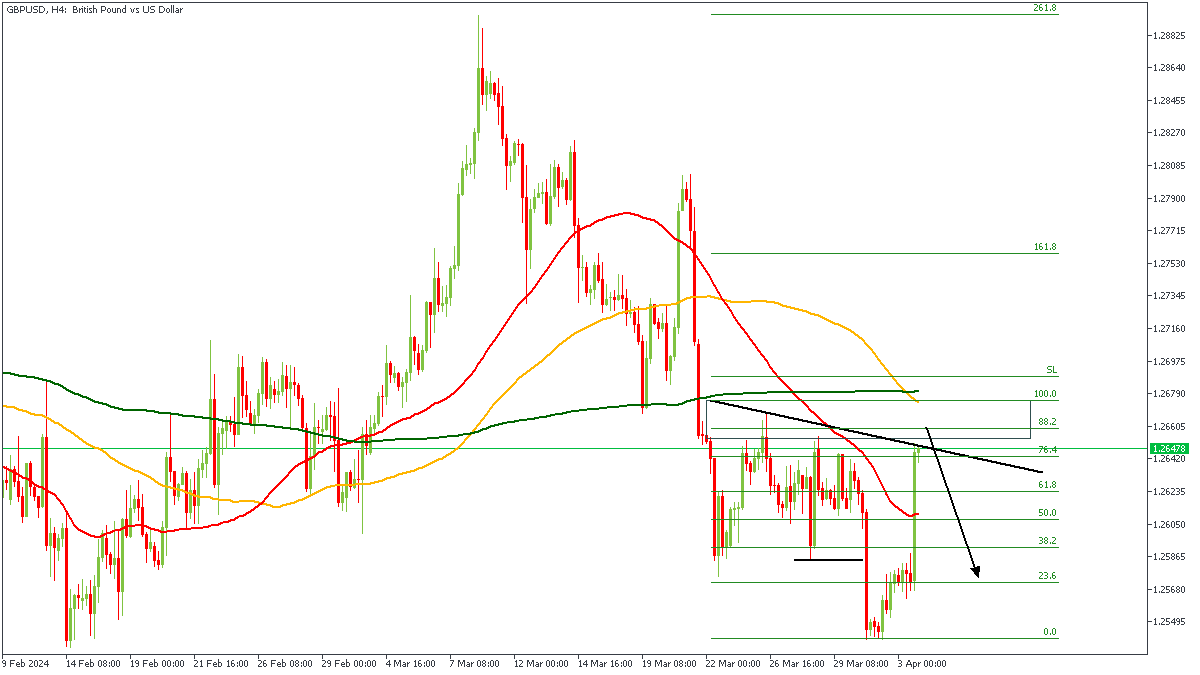

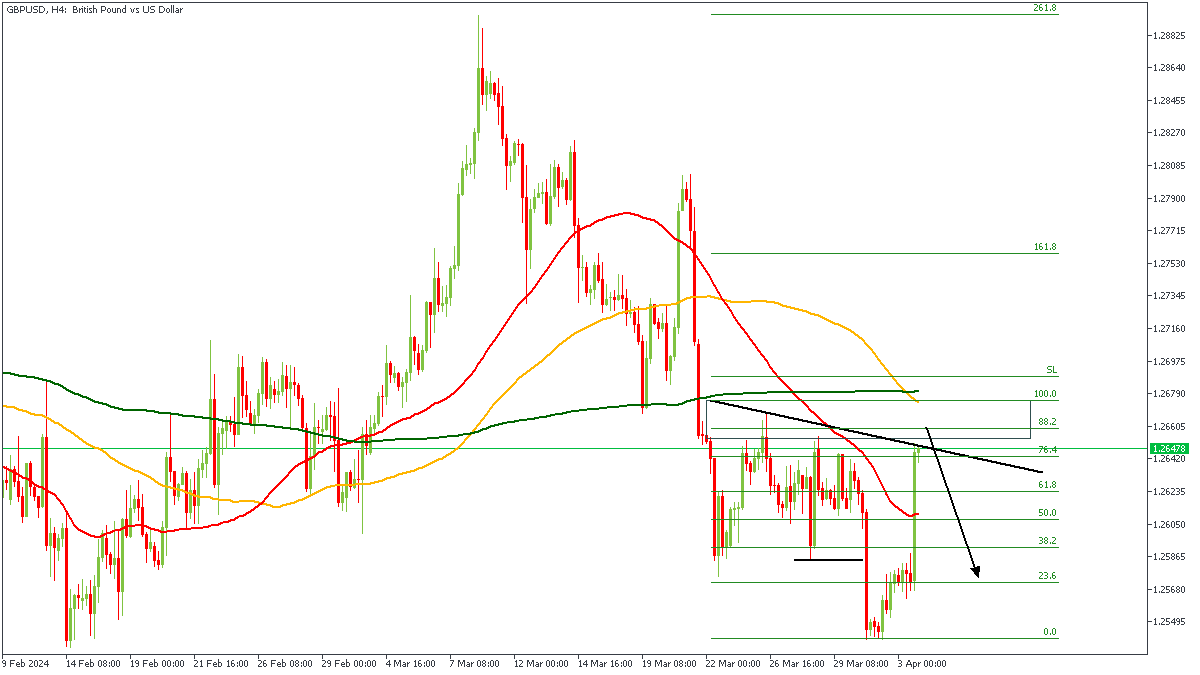

GBPUSD - H4 Timeframe

GBPUSD is currently reflecting the price action on EURUSD, albeit with some slight modification. Here on the 4-hour chart of GBPUSD, we see the initial break of structure, and the race to retest the supply zone that engineered that break. Also, we clearly see the bearish array of the moving averages, the 88% Fibonacci retracement level, trendline resistance, as well as the overlap of the 100 and 200 moving averages with the rally-base-drop supply zone. All these point to the likelihood of a bearish outcome.

Analyst’s Expectations:

Direction: Bearish

Target: 1.25897

Invalidation: 1.26766

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.