USDCAD began the week slightly higher reaching as high as 1.2510 but failed to sustain these gains.

2021-05-26 • Updated

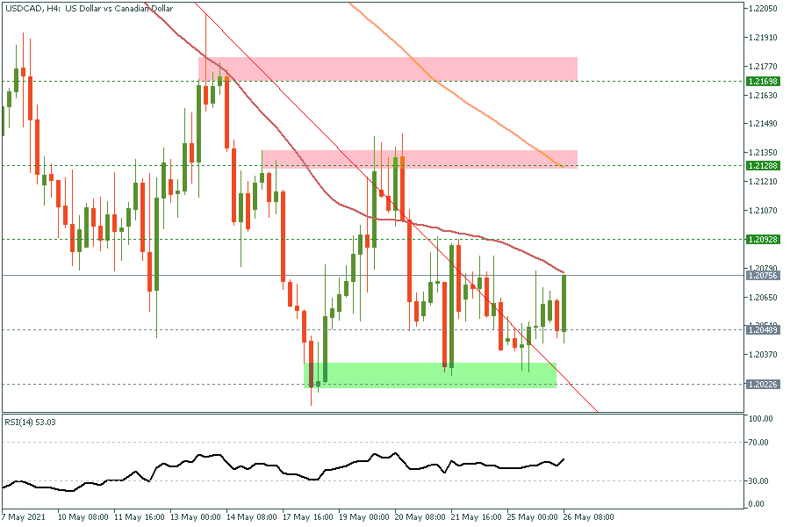

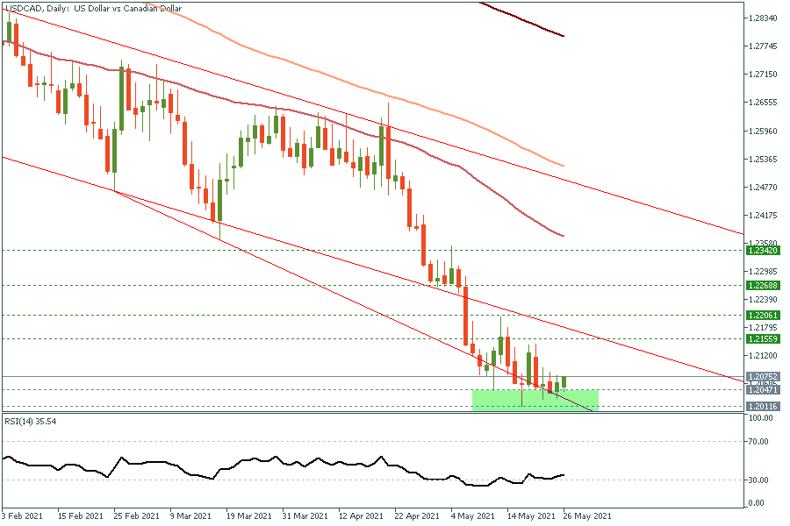

USD/CAD has been trading within a tight range for over two weeks now and holding well above 1.2050’s. The technical indicators are turning higher on the daily chart, which suggests a possible correction to the upside. The area between 1.2060 and 1.20 represents a solid support area which goes back to 2017 when the pair bottomed out and began a long-term bull run that lasted for over two years. Therefore, the current stabilization within the same area would be an opportunity to nibble some longs while the stop loss should not exceed 1.1980. On the upside move, 1.22 could be a reasonable first target in the next few days followed by 1.2235 for now.

| S3 | S2 | S1 | Pivot | R1 | R2 | R3 |

|

1.1960 |

1.2009 |

1.2038 |

1.2058 |

1.2087 |

1.2107 |

1.2156 |

USDCAD began the week slightly higher reaching as high as 1.2510 but failed to sustain these gains.

All eyes are headed toward the Bank of Canada today. Estimates point to no change both for the main rate and the ongoing QE which stands at $3B weekly.

USD/CAD managed to advance further yesterday breaking above 1.21, reaching as high as 1.2128 earlier today, while our long signal that was issued at 1.2060 is now in profit with over +60 pips.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!