-

Bagaimana cara untuk mula berdagang?

Jika anda berumur 18+, anda boleh sertai FBS dan mulakan kembara FX anda. Untuk berdagang, anda perlukan sebuah akaun perbrokeran dan ilmu yang mencukupi tentang tindak-tanduk aset di pasaran kewangan. Mulakan dengan mempelajari ilmu-ilmu asas menerusi bahan-bahan pengajian percuma kami dan buka akaun di FBS. Mungkin anda mahu mencuba suasana perdagangan dengan wang maya di akaun Demo terlebih dahulu. Apabila anda sudah bersedia, masuk ke pasaran sebenar dan berdagang untuk berjaya.

-

Bagaimana cara membuka akaun di FBS?

Klik butang 'Buka akaun' di laman web kami dan teruskan ke Laman Pedagang. Sebelum anda boleh mula berdagang, lengkapkan pengesahan profil. Sahkan emel, nombor telefon, dan ID anda. Prosedur ini menjamin keselamatan dana dan identiti anda. Setelah proses pengesahan lengkap dan lulus, pergi ke platform perdagangan pilihan anda, dan mula berdagang.

-

Cara-cara mengeluarkan wang yang anda raih di FBS?

Prosedurnya sangat mudah. Pergi ke halaman Pengeluaran di laman web atau seksyen Kewangan dalam Laman Pedagang FBS dan buat pengeluaran. Anda boleh mendapatkan wang yang diraih menerusi sistem bayaran yang sama yang anda gunakan untuk deposit. Sekiranya anda memasukkan dana ke dalam akaun menerusi pelbagai kaedah, keluarkan keuntungan anda dengan kaedah-kaedah yang sama dalam nisbah yang sama.

Moving Averages Ribbon: How to Find Entry Point

What is MA Ribbon?

Moving average ribbons are a series of moving averages (MA) of different lengths that are plotted on the same chart to create a ribbon-like indicator. Traders can determine the strength of a trend by looking at the distance between the moving averages. The ribbons can also be used to signal potential trend changes when the price moves through lines, or lines cross each other.

You can download this indicator for MT5 using the link!

How to set up a Moving Average Ribbon?

It is all about traders’ preferences. Some traders like to use six to eight simple moving averages (SMA) set at 10-period intervals, such as the 10, 20, 30, 40, 50, and 60-day SMAs. Others prefer to use only two lines and open trades when the lines cross each other.

Traders can also choose between types of moving averages. Some of them prefer simple and others use exponential lines. The EMA reacts quicker to price changes and the SMA reacts slower. That is the main difference between the two. One is not necessarily better than another. Sometimes the EMA will react quickly, causing a trader to get out of a trade on a market hiccup, while the slower-moving SMA keeps the person in the trade, resulting in a bigger profit after the hiccup is finished. At other times, the opposite could happen. The faster-moving EMA signals trouble quicker than the SMA, and so the EMA trader gets out of harm's way quicker, saving that person time and money.

Each trader must decide which MA is better for his or her particular strategy. Many shorter-term traders use EMAs because they want to be alerted as soon as the price is moving the other way. Longer-term traders tend to rely on SMAs since these investors aren't rushing to act and prefer to be less actively engaged in their trades.

Also, traders can choose the MA period. The lower meaning of period makes MA reflect more precisely on price changes.

How to trade with MA Ribbon?

This article will describe the simplest example of MA ribbon, but it is not less effective. On the contrary, it will protect traders from the market’s hiccups.

In this strategy, only 2 moving average lines are used. One is the “fast MA” line and the other is “Slow MA”.

We have chosen settings that are designed for daily and long-term traders.

The settings are:

Fast time frame: current

Fast MA period: 12

Fast MA method: Simple moving average

Fast MA price: Close

Slow time frame: current

Slow MA period: 85

Slow MA method: Exponential moving average

Slow MA price: Weighted

As a result, we get 2 lines. If the fast line crosses the slow one from the bottom, an uptrend will begin. On the contrary, the downtrend starts if the fast line crosses the slow one from the top.

Let’s look at the example!

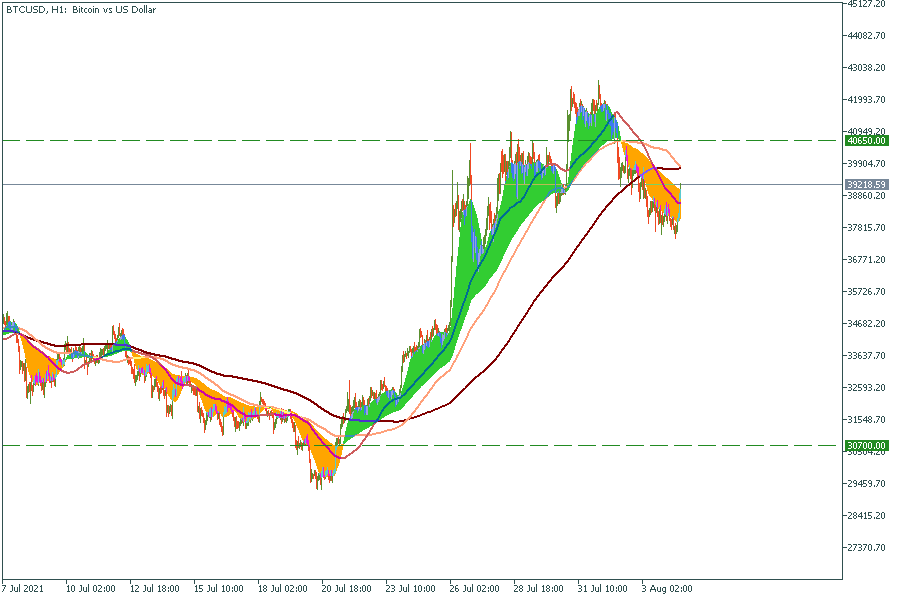

1H BTC Chart

Using the MA ribbon strategy trader could open the deal after the fast line crossed the slow one ($30700 level on the chart). It is important to set a stop-loss. If it is a long trade, traders set stop-loss below an entry point. If it is a short one, traders set stop-loss above an entry point. In our case, stop-loss must be set right below $40700. The position closes when lines cross each other again ($40650 level on the chart) or if the price reaches the trader’s target.

Let’s look at one more example!

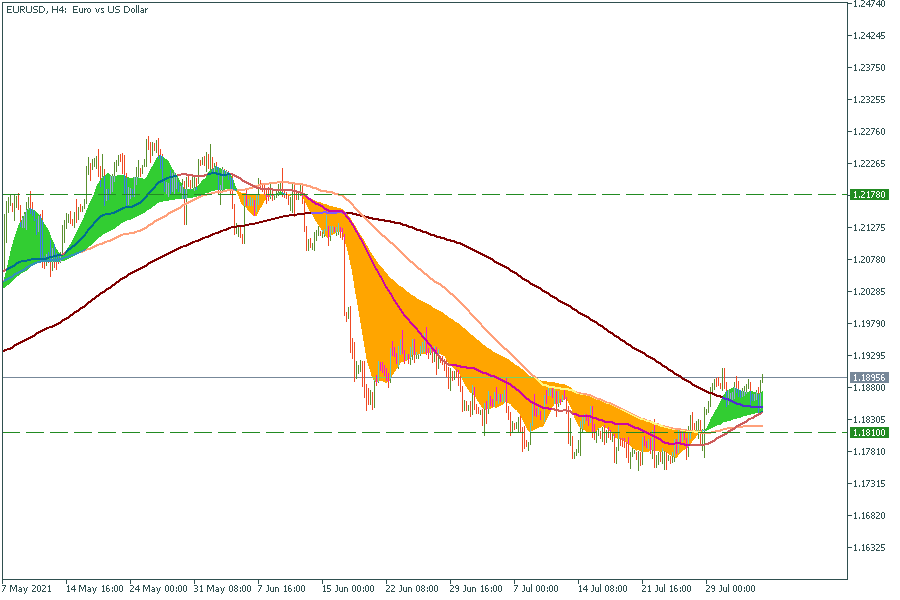

4H EUR/USD chart

On the EUR/USD chart the place of hiccup appearance is highlighted. It is a great example of stop-loses importance as during flat market movement lines might cross each other several times in both directions.

Conclusions

- Traders can set this instrument according to their strategy and a time frame they prefer to use. For daily traders, it is better to use EMAs and set lower meanings period meanings.

- It is highly important to use stop-loses.

- Traders must set targets before they open a trade or take profit after the lines cross each other the opposite way.

2022-10-10 • Dikemaskini

Artikel-artikel lain di bahagian ini

- Osilator McClellan

- Strategi Perdagangan Indikator Aroon

- Kekuatan matawang

- Rangka Masa Terbaik Untuk Perdagangan

- Carta Renko

- Jenis-jenis carta

- Bagaimanakah Cara Untuk Menggunakan Carta Heikin-Ashi?

- Dasar Pelonggaran Kuantitatif (QE)

- Titik Pivot

- Apakah itu indikator ZigZag?

- Purata Bergerak: cara mudah untuk mengesan trend

- Williams’ Percent Range (%R)

- Apakah itu Relative Vigor Index (Indikator RVI)?

- Momentum

- Force Index

- Apakah Itu Indikator Envelopes?

- Bulls Power dan Bears Power

- Average True Range

- Bagamana cara berdagang berdasarkan keputusan bank pusat?

- CCI (Commodity Channel Index)

- Sisihan Piawai

- Parabolic SAR

- Berdagang dengan Osilator Stokastik

- Relative Strength Index

- MACD (Moving Average Convergence/Divergence)

- Osilator

- Indikator ADX: Cara Menggunakannya Untuk Analisis Trend Forex Yang Berkesan

- Jalur Bollinger

- Indikator trend

- Pengenalan kepada indikator-indikator teknikal

- Sokongan dan rintangan

- Trend

- Analisis Teknikal

- Bank Pusat: polisi dan akibat

- Faktor Fundamental

- Analisis Fundamental di dalam perdagangan Forex dan saham

- Analisis fundamental vs teknikal