-

How to open an FBS account?

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Leverage and Margin: How Can You Use Them in Forex Trading?

There are two things that a trader needs to know about how Forex works before they start trading. These are leverage and margin.

What is leverage in Forex?

Leverage is essentially borrowed capital. It is a sum of money that your broker provides to you so that you could have greater flexibility when trading on Forex. Since the Forex market is huge, lots can be overwhelmingly large. Leverage allows you to trade larger lots and open more positions without putting all of your equity into one huge trade.

Example of leverage

Here’s an example to help you on the way. Suppose you decide to use the 1:100 trading leverage. This means that out of 100% of the money, you provide only 1%, while your broker provides the other 99%.

You probably know that when trading on Forex, you are trading lots. One lot usually is 100 000 monetary units in the base currency of the trade. The minimum trading volume usually equals 0.01 lots or 1 000 monetary units of the base currency.

If you are buying EURUSD, the minimum purchase is 1 000 dollars. It can be a lot for a trader, and they can open only one position with this sum. However, if the trader is using 1:100 leverage, they need to provide 1% or $10 (the broker will provide the remaining $990). Still, the profit or loss will be calculated on the whole leveraged sum.

The change in currency value is measured in points. Depending on the currency, its volatility, and liquidity, different pairs can have different points: for EURUSD, one point equals 0.00001.

Suppose some major financial event affects the USD price, and it declines by 500 points. If a trader purchases 0.01 lots of EURUSD ($1 000), their profit will be equal to position size (0.01) multiplied by the number of points (500). The profit on the trade will be $5, or 0.5% (0.01 * 500 = 5).

If a trader has no leverage, they put $1 000 in the trade and profit $5 or 0.5%. If a trader uses the 1:100 leverage and conducts the same trade, their own investment will be only $10, but the profit will stay $5, making it a 50% profit. At the same time, using all your leverage (1:100) and opening a whole 1-lot trade would result in $500 worth of profit.

Forex brokers offer a wide variety of leverage sizes and have different leverage rules. For example, FBS offers 1:50, 1:100, 1:200, 1:500, 1:1000, 1:2000, and 1:3000 leverages. At FBS, the leverage can vary for different accounts and can be accessed through Personal Area and changed in the Account settings. You need to choose leverage that is the most suited for your skills.

Risk of leverage

Leverage increases the volatility of your portfolio. Simply put, with leverage you can earn more with the same amount of money. However, you will lose more, too.

For example, with 1:100 leverage, you may open a $10 000 trade having only $100 on your account. If the trade moves 1% in your direction, you will get $100 of profit. Conversely, a 1% move in the opposite direction will result in a $100 loss.

What is a margin in Forex?

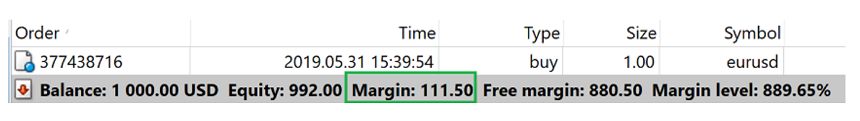

Now that you know what leverage is, the margin is easy: in Forex trading, the margin is a sum of money that is required to open a position. In the example below, $111.50 is the margin a trader provides in case of using 1:100 leverage.

The funds that you hold in your trading account are the money you use as a margin when trading on Forex. If you expect to get some profit, you can use a large leverage ratio and smaller margin to control a bigger trade size.

Margin requirements

Forex margin requirement depends on the leverage ratio that the trader chooses, as well as the lot size and the instrument. Let us show you examples of the FBS leverage and margin required to use it:

|

Leverage |

Margin requirement |

Margin requirement for one EURUSD lot (or $100 000) |

|

1:50 |

2% |

$2000.00 |

|

1:100 |

1% |

$1000.00 |

|

1:200 |

0.5% |

$500.00 |

|

1:500 |

0.2% |

$200.00 |

|

1:1000 |

0.01% |

$10.00 |

|

1:2000 |

0.05% |

$50.0 |

|

1:3000 |

0.033333333% or 1/30% |

$33.33333 or $3 and 1/30 |

Your trading platform shows you free margin (or usable margin) and margin level figures. A free margin is money in your account that can be used to maintain your open positions or open new ones. The margin level is the percentage that shows the trader how much of their funds is not being used at the moment.

Margin call

If one of your open trades is a losing one, your margin level will be going down, and to avoid losing all of the money, brokers use the so-called margin call. A margin call is a specific margin level (at FBS, it equals 40%) that, once reached by the trader, initiates a warning to make sure the trader either closes the losing trades or deposits more funds into the account. Read about the margin call definition in FBS Glossary.

Stop-out level

Once the margin level drops to the minimum allowed level or stop-out level (at FBS, it's 20%), some trades, starting with the most losing ones, will be closed automatically to prevent the trader's negative balance.

Equity, margin level, and free margin change in real time, so pay close attention to those numbers, especially if you use a larger leverage ratio. Leverage can lead to big profits with smaller investments. Still, the same formula applies to loss, so be careful when deciding on leverage: sure, your profits will multiply, but in case of a loss, that will multiply as well.

Margin and leverage: the difference

Leverage in Forex is borrowed capital that allows you to increase your trading volume and potential returns. It is a sum of money brokers lend to traders to have greater flexibility when trading on Forex.

Margin, on the other hand, is the sum of money required from traders to open a position. The funds held in a trader's account are the money used as a margin. It is needed to cover potential losses that may occur during trading. The margin requirement depends on the leverage ratio, lot size, and instrument and can be found in the trader's account.

Both leverage and margin are vital. Leverage gives you more power in your trades, and margin protects your balance from going below zero. Use this knowledge to succeed, and good luck!

2023-05-03 • Updated

Other articles in this section

- How to Make Money on Forex

- Economic Calendar: How to Read and Use

- How to open and close a trade in MetaTrader?

- How Much Do You Need to Start Trading Forex

- Forex Demo Account

- How to determine position size?

- What Are Rollover and Swap and How to Use Them When Trading?

- Types of Trading Orders: Market, Limit, Stop, Trailing Stop, Stop-Limit

- When is the Forex Market Open?

- What Are Bid, Ask, and Spread?

- Calculating profits

- What are Lots, Points, and Leverage

- How to trade?

- Currency Pairs in Forex Trading

- What Software Do You Need for Trading?

- The Advantages and Risks of Trading Forex

- What is Forex Trading?