-

How to open an FBS account?

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

When is the Forex Market Open?

Forex market is open 24 hours a day, five days a week. Trading sessions correspond to when stock markets are open in a particular world region. Usually, trade volume is higher at the intersection of the sessions. Forex trading time always begins in Australia and New Zealand and then spreads to Asia. After that, it’s Europe's turn, and finally, the United States and Canada join in.

You can trade anytime you wish during the working week. You can open your currency position for a couple of hours or even less (intraday trading) or for a couple of days (long-term trading) – just as you see fit.

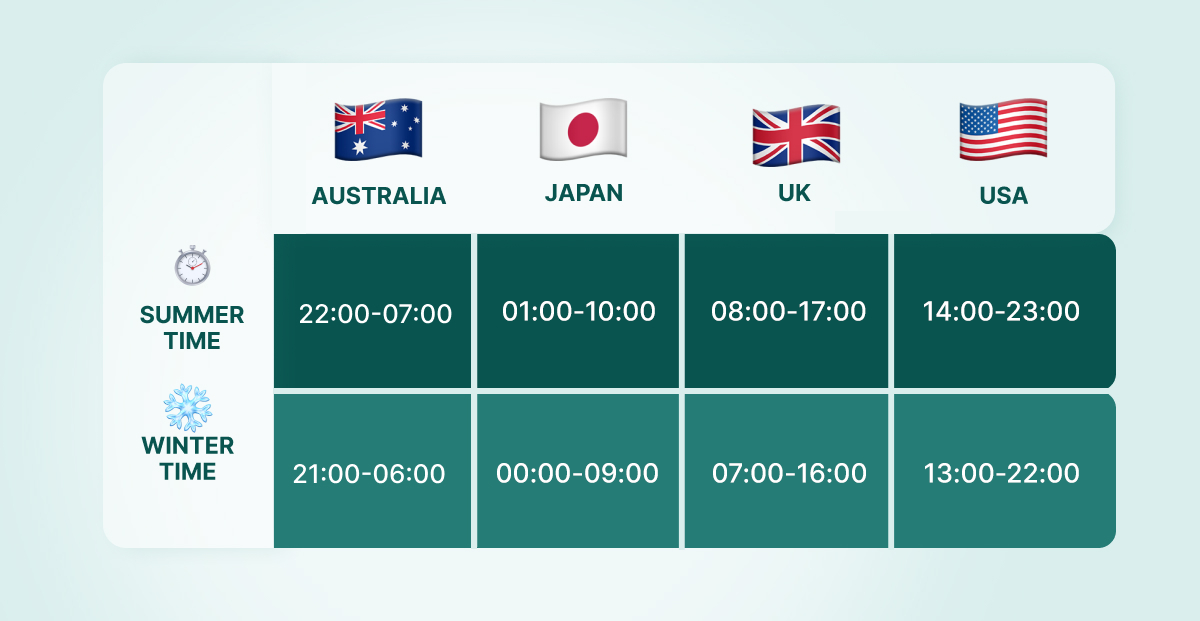

Approximate time of trading sessions (GMT)

There are four types of Forex trading sessions: Australian (Sydney), Asian (Tokyo), European (London), and North American (New York). Some traders call them by the continents’ names, while others call them by their capitals.

The trading week starts on Monday morning in New Zealand, while it’s still Sunday for the rest of the world.

- The Australian trading session lasts from 21:00 to 06:00 (UTC+0).

- The Tokyo trading session starts at midnight and ends at 09:00 (UTC+0).

- The London trading session lasts nine hours, from 07:00 to 16:00 (UTC+0).

- Finally, New York Forex market hours are from 13:00 to 22:00 (UTC+0).

Traders usually focus on one of four Forex trading sessions.

The New York and London trading sessions are the busiest. Some traders consider the period between the London and the New York trading sessions the best time for Forex trading due to active markets.

On the contrary, the time between 19:00 and 22:00 (UTC+0) is the lowest volatility. This happens because most American traders leave the active markets, and the Australian traders step in.

It’s essential to mind daylight saving time (DST). This is the practice of setting the clocks an hour back in the fall and an hour forward in the spring.

Due to this, the Forex market timings are different in the summer and winter.

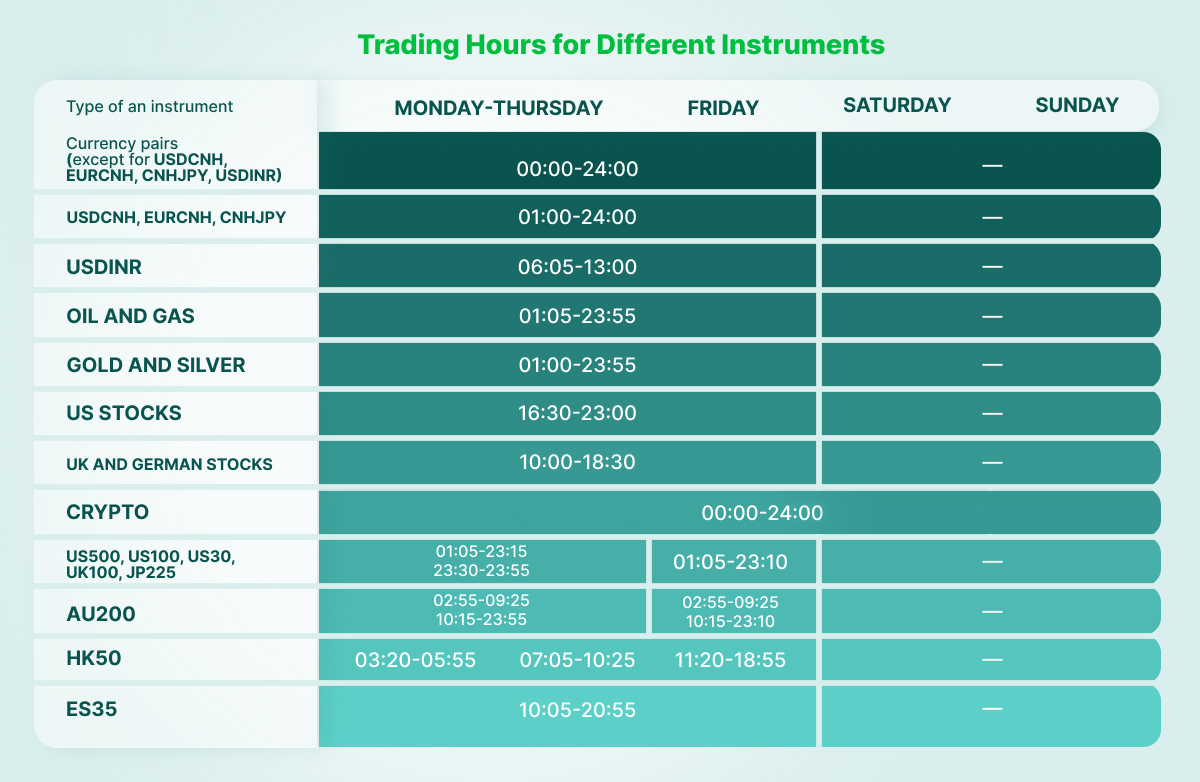

Trading schedule for different instruments

You need to remember that the trading schedule differs for different types of instruments. While most Forex pairs are open for trading non-stop Monday to Friday, there are some exceptions.

Such instruments as metals, oil, gas, US stocks, and indices are traded Monday to Friday, but their trading hours differ. The open time for the gold and silver (XAUUSD and XAGUSD), USDCNH, EURCNH, and CNHJPY on the Forex market is 01:00 MetaTrader time. The close time for metals is 23:55 MetaTrader time. Oil and gas prices (XBRUSD, XTIUSD, XNGUSD) open five minutes late at 01:05 MetaTrader time.

You can trade US stocks at 16:30-23:00 MetaTrader time. The UK and German stocks’ Forex hours are 10:00-18:30 MetaTrader time.

Indices have a specific schedule. US500, US100, US30, UK100, and JP225 are open from 01:05 to 23:15 MetaTrader time and 23:30 to 23:55 MetaTrader time on Monday-Thursday, and 01:05 to 23:10 MetaTrader time on Friday.

AU200 is open from 02:55 to 09:25 MetaTrader time, 10:15 to 23:55 MetaTrader time on Monday-Thursday, 02:55 to 09:25 MetaTrader time, and 10:15 to 23:10 MetaTrader time on Friday.

HK50 is open thrice daily: 03:20-05:55, 07:05-10:25, and 11:20-18:55 MetaTrader time. ES30 is open 10:05 to 20:55 MetaTrader time.

Cryptocurrencies are available for trading throughout the whole week.

The table below will let you check the exact trading hours for any instrument you can trade with FBS.

The reasons for 24-hour trading

24-hour trading on Forex allows trading at any time convenient to market participants worldwide. For example, a trader from the United States can trade alongside a trader in Europe during their respective local business hours.

Forex market liquidity also plays a vital role in a non-stop trading process. That is, traders can buy and sell currencies through a trading platform in one single click, even during off-hours.

Also, 24-hour trading on Forex lets participants take advantage of the news outside their working hours. Thus, traders can access trading instruments anytime, responding to market changes and unexpected events.

Fluctuations in Forex prices

Prices on the Forex market constantly fluctuate. It happens because of the change in the balance between buyers and sellers, or supply and demand. When the demand for a particular currency is greater than the supply, the value of that currency will increase compared to other currencies.

On the contrary, when the currency's supply is greater than its demand, the value of that currency will decrease relative to other currencies.

Conclusion

The Forex market allows traders to trade 24 hours a day, five days a week, with trading sessions corresponding to the opening hours of stock markets in different parts of the world. The four main trading sessions are the Australian, Asian, European, and North American, with the London and New York sessions being the busiest.

It's important to remember that the trading schedule varies for different types of instruments. Traders need to check the exact trading hours for any trading instrument they want to trade to avoid confusion. To do that, they can visit the FBS Guidebook or check the specifications of each instrument directly through MetaTrader.

The 24-hour trading on Forex enables traders to take advantage of news and market changes outside their working hours, with prices on the Forex market constantly fluctuating.

2023-05-25 • Updated

Other articles in this section

- How to Make Money on Forex

- Economic Calendar: How to Read and Use

- How to open and close a trade in MetaTrader?

- How Much Do You Need to Start Trading Forex

- Forex Demo Account

- How to determine position size?

- Leverage and Margin: How Can You Use Them in Forex Trading?

- What Are Rollover and Swap and How to Use Them When Trading?

- Types of Trading Orders: Market, Limit, Stop, Trailing Stop, Stop-Limit

- What Are Bid, Ask, and Spread?

- Calculating profits

- What are Lots, Points, and Leverage

- How to trade?

- Currency Pairs in Forex Trading

- What Software Do You Need for Trading?

- The Advantages and Risks of Trading Forex

- What is Forex Trading?