What will happen?

Nvidia will present its earnings report for the fourth quarter on February 16 after the stock market closes (23:00 GMT+2). In addition, Nvidia's management will hold a live question and answer webcast at 00.30 MT, February 17, to discuss its financial and business results.

Why is it important?

Nvidia is a leading manufacturer of high-end graphics processing units (GPUs). GPUs are used in embedded systems, mobile phones, personal computers, workstations, and game consoles. Modern GPUs are very efficient at manipulating computer graphics and image processing. There are several reasons for Nvidia's earnings report to beat the market's expectations:

Mining popularity growth

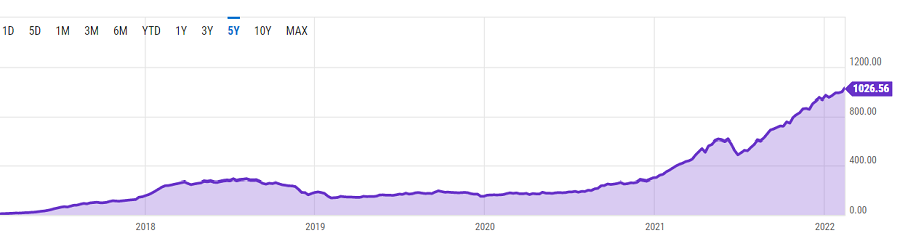

Nowadays, miners form the most significant part of the demand for GPUs. As we can see on the screen below, the global Ethereum hash rate is gaining momentum, which means more and more GPUs are getting used. Therefore, we can assume Nvidia to show great revenue in Q4.

Global Ethereum hash rate. Ethereum is the №1 coin to mine on GPUs.

Metaverses

GPUs are also used to run metaverses, becoming a new driver for the technology sector. So far, there are already more than ten global projects, and even more, will appear in 2022. It is clear Nvidia benefits from this trend as the largest equipment supplier for this sector.

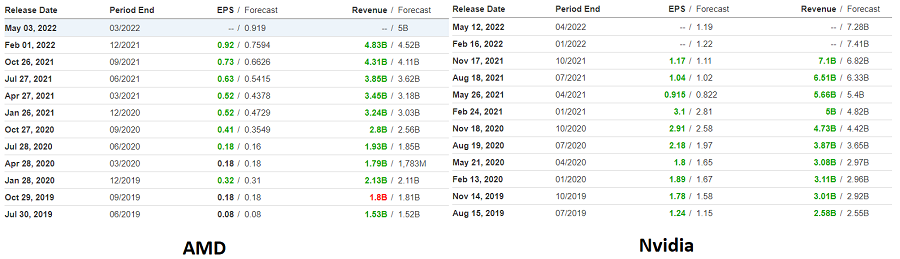

AMD outperformed expectations

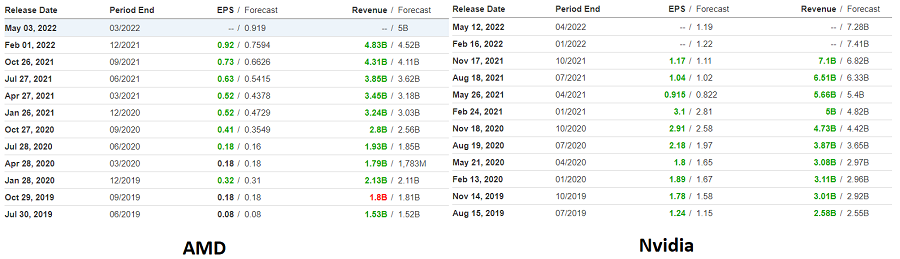

The main Nvidia's competitor, AMD, already published a revenue report for Q4 2021 on February 2, with the 6.8% advantage above expectations. On February 3, the stock opened 10% higher. If we compare Nvidia's and AMD's reports, we can notice these companies show similar results since 2019.

On January 25, Nvidia refused to buy the British company Arm from SoftBank amid unsuccessful attempts to obtain approval for a deal worth $40 billion from regulators. Therefore, there is no significant spending affecting the report.

According to these facts, we assume Nvidia's report will surprise investors and positively impact the stock price.

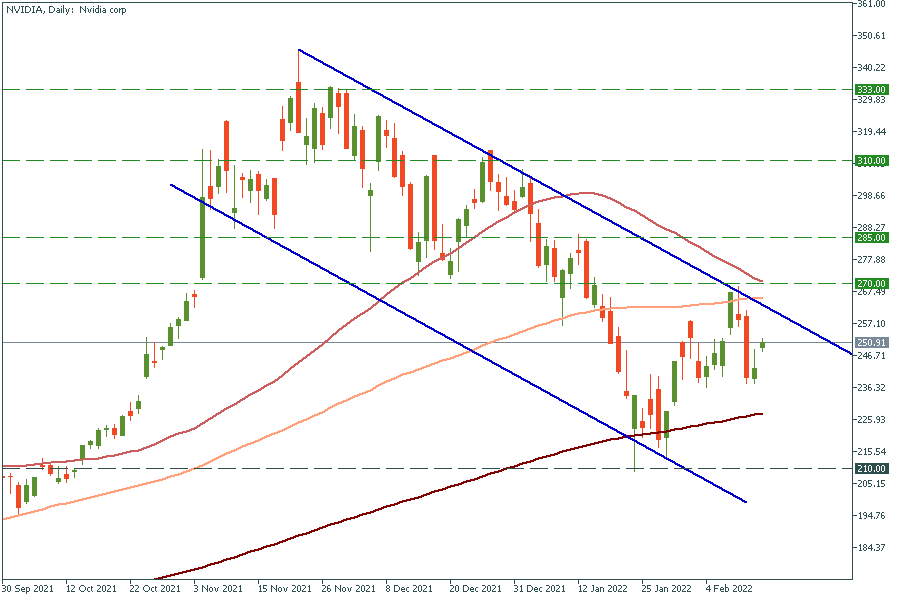

Technical analysis

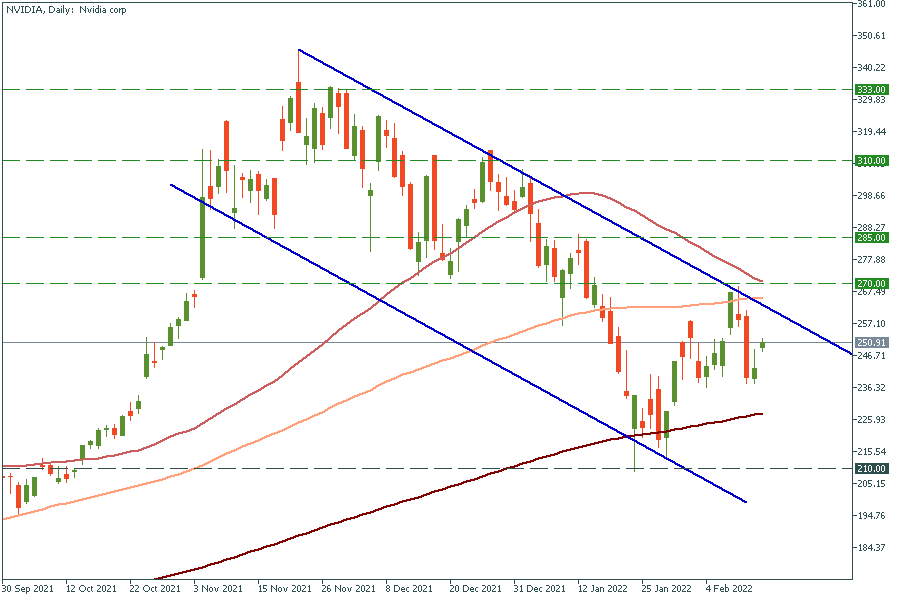

Nvidia, daily chart

The price has been moving in the descending channel since November 2021. The upcoming earnings report is an excellent opportunity to break through the upper border of this channel and continue the rally. Better than expected earnings report will send the stock to $270, an intersection of 50- and 100-day moving averages. If the price breaks through this resistance, we will see a pump with targets at $285, $310, and $333.

On the other hand, if the earnings report disappoints investors, the stock might fall to $210 support.

Don't know how to trade stocks? Here are some simple steps.

- First of all, be sure you've downloaded FBS Trader app or Metatrader 5. FBS allows you to trade stocks only through this software.

- Open an account in FBS Trader or the MT5 account in your personal area.

- Start trading!